Best Mobile Wallet App for Android In India

November 8, the day Prime Minister Narendra Modi announced the government’s decision to demonetize Rs. 500 and Rs. 1,000 notes, the scramble for alternative modes of money transfer has led many to the concept of mobile wallets. A Mobile Wallet is a form of an e-wallet which basically is a virtual wallet that allows people to store their money and use it for people-to-people transactions and making purchases. It does away with the need to input personal information and serves as a platform for both offline and online purchases. PM Narendra Modi in his speeches has called for a move from “less cash society to a cashless one”. It means the PM wants you to go digital with your wallet, or in simpler words to use e-wallets for day-to-day purchases and other transactions.

India aims to become cashless now. The online mode of payments has been increased, and most of us are looking for secure and safe ways of doing it. If you are also looking for the same, then this Blog is for you. In this blog, we are going to discuss the Best Mobile Wallets app that are currently available in India. The list below is mainly about the best mobile wallet app for Android as there are dozens of Mobile wallet solutions on offer today, from tech companies, telecom players, and banks. so, it’s important to know about the specific mobile wallets that can prove handy to you. The list below will help you decide as per your need by educating you about these major available e-wallets in the country.

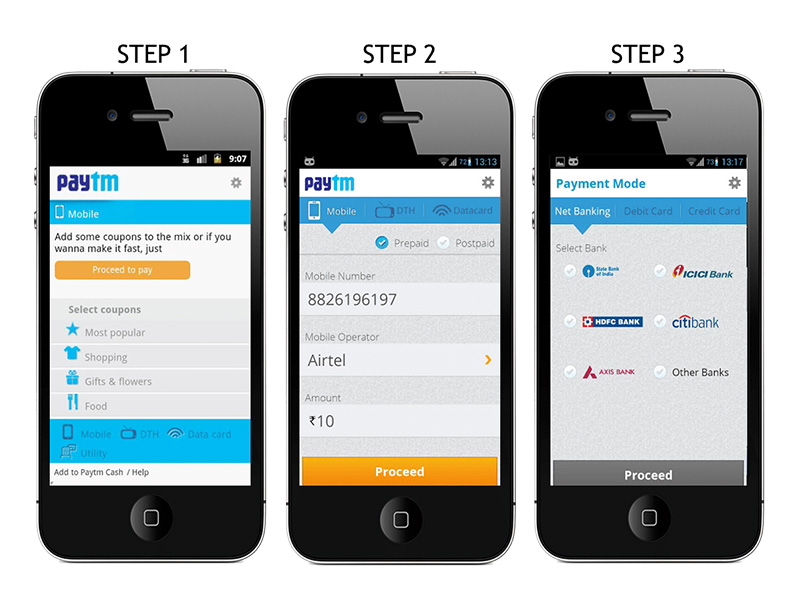

Paytm:

Paytm is the most visible player in the e-wallet category in India. The company, which was founded back in 2010 as a mobile recharge website by One97 Communications, is now invested in by the likes of Alibaba and Ratan Tata. Paytm recently said that it recorded transaction worth Rs 120 crore on single day post demonetisation. While the app, which is available on every mobile platform, already had a vast outreach, after the demonetisation announcement by the PM it has become more visible.

Paytm can be accessed through its website and is also available on all the phone platforms as an app. By using Paytm you can pay phone and internet bills, utility bills like electricity, gas, and water. You can also pay DTH bills, recharge prepaid numbers and also recharge metro cards for Delhi and Mumbai metro trains. Paytm allows you to book tickets for the train, flight or bus journey. You can also book your stay at hotels through your Paytm account. Movie tickets can also be booked from the Paytm site and app. Using Paytm you can also pay school fees, buy gold in stocks or get a loan or insurance.

Paytm doubles up as a wallet, which means you can store money in it and use it when needed. Cab-hailing services like Uber, Meru, TaxiForSure and Jugnoo support Paytm Wallet, which means you can hire a cab and pay using the money in your Paytm Wallet. You can send and accept payments from customers, friends or family. It can be done by scanning a QR code or through OTP verification that works with a mobile phone. Paytm is accepted across a wide number of local kirana stores, retail store, restaurants, and petrol pumps. The app offers a “nearby” option which shows all the places near your location that accept payment through Paytm. Paytm is also accepted for most online retailers. Paytm also has its own online shopping market, where it sells products in women and men fashion, mobiles & electronics, home & kitchen, accessories, jewelry, home appliances, baby & kids and more.

Paytm is the most widely used way of offline digital transaction, which means it’s easy to find local stores where Paytm payment is accepted. As mentioned above, Paytm offers the widest range of options where it can be used. The money stored in Paytm Wallet can be used for sending money, purchases, cab rides and much more.

links for first-hand experience of Paytm services:

- Paytm official website

- Paytm App Free Download on Android

- Install Paytm App for iOS

- Windows Paytm Application Download

- Paytm App Installation for Blackberry

Mobikwik:

Mobikwik is another option available to Indians when it comes to the cashless transaction. It also started as prepaid recharge website, it works closely similar to Paytm. However, the places and the services where you can use Mobikwik are fewer. Mobikwik is available on Android, iOS and Windows platforms.

Mobikwik is another option available to Indians when it comes to the cashless transaction. It also started as prepaid recharge website, it works closely similar to Paytm. However, the places and the services where you can use Mobikwik are fewer. Mobikwik is available on Android, iOS and Windows platforms.

Most of the services offered by Mobikwik are the same as Paytm. It allows mobile recharge, bill payments for utilities like electricity, water, and gas. You can also pay DTH, internet bills. Mobikwik allows bus and train bookings but not flights. Mobikwik payment is accepted at more than 5000 restaurants, cafe, supermarkets, gift shops & physical stores.

The Mobikwik wallet option is also supported for online transaction on several websites. Transfer and receive money through the app. Accepted at a lot of places. Allows transferring money back to the bank account. Mobikwik Lite offers smooth functioning even on the slow internet. It doesn’t require a smartphone. Limited reach compared to Paytm.

For further information, one can access below links

- Mobikwik Website

- Free Download MobiKwik App for Android

- Download MobiKwik iOS App

- Install MobiKwik Windows App

Recommend read: Top 5 Video calling apps for distance calling

Freecharge:

Freecharge works and offers services more or less similar to Paytm and Mobikwik. The app is available on Android, iOS, and Windows mobile platforms. While the Freecharge payment is not accepted on major services like Uber and Ola, it offers some interesting features like “split bill”, which allows you to split the amount to be paid among your friends.

Freecharge works and offers services more or less similar to Paytm and Mobikwik. The app is available on Android, iOS, and Windows mobile platforms. While the Freecharge payment is not accepted on major services like Uber and Ola, it offers some interesting features like “split bill”, which allows you to split the amount to be paid among your friends.

With the efficient Freecharge Wallet, it’s time to go cashless and reduce the extensive process of online and offline payments to just one tap. Freecharge has some of the most popular merchants on board – for categories like food, entertainment, travel & shopping.

Use below links to access Freecharge

PayUmoney:

PayUMoney, a Gurgaon-based company that provides online payment solutions launched its wallet service last year. This e-wallet by PayUMoney enables the user to store cash and pay for various services and transactions.

PayUMoney, a Gurgaon-based company that provides online payment solutions launched its wallet service last year. This e-wallet by PayUMoney enables the user to store cash and pay for various services and transactions.

In order to differentiate themselves from other players, they provide a wide range of benefits that include one-touch checkout and discounts/cashback offers on every transaction made. This e-wallet also provides instant refunds on order cancellations to ensure the right purchase and customer satisfaction.

You can access PayUmoney service by:

Recommend read: Best Smartphones Under Rs. 10,000

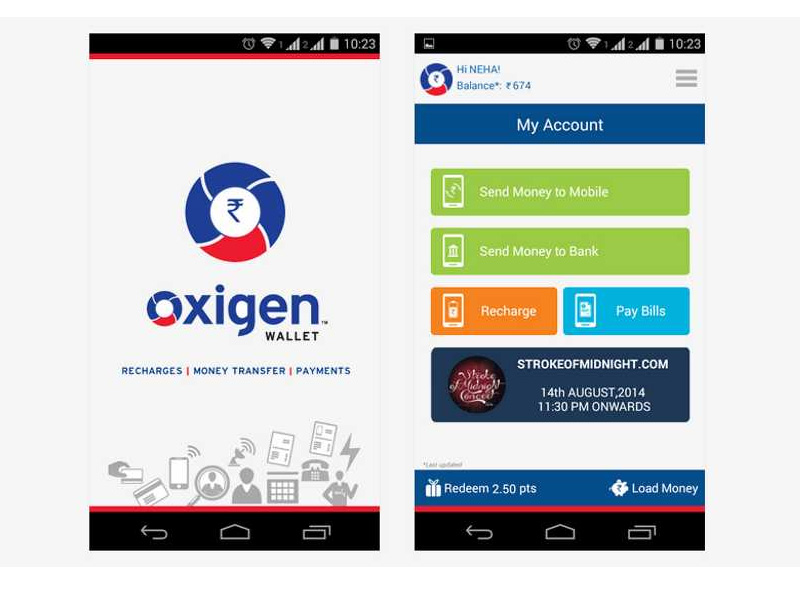

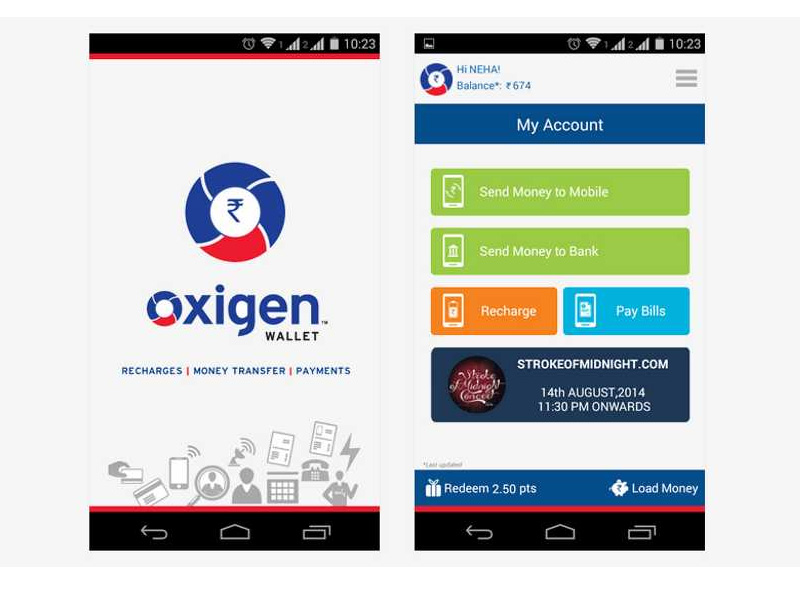

Oxigen Wallet:

The Oxigen wallet (e-wallet) is powered by Oxigen Services India Private Ltd., that was founded way back in 2004 by Pramod Saxena in the tie-up with Blue Label Telecom, which is a South African company. Though it ventured into the online mobile wallet space only in 2014, it has established itself as a leader among retail outlets for payment services with more than 1,30,000 outlets across India and more than 35 million transactions being conducted on a monthly basis.

The Oxigen wallet (e-wallet) is powered by Oxigen Services India Private Ltd., that was founded way back in 2004 by Pramod Saxena in the tie-up with Blue Label Telecom, which is a South African company. Though it ventured into the online mobile wallet space only in 2014, it has established itself as a leader among retail outlets for payment services with more than 1,30,000 outlets across India and more than 35 million transactions being conducted on a monthly basis.

Oxigen Wallet is a prepaid non-bank wallet that has been approved by RBI. It has emerged as India’s first non-bank wallet in the tie-up with NPCI for instant money transfer services. You can use Oxigen wallet to transfer money quickly from your mobile at any time and from anywhere. The transfer can be made to any mobile phone number on any cellular network in India as well as to any bank account PAN India using IMPS (Immediate Payment Service) or NEFT transfer to most major banks like SBI, Citibank, Axis bank, HDFC Bank, Yes bank, ICICI Bank, IOB, PNB, etc. in India.

The best part about Oxigen wallet is because it is certified by RBI, it is pretty reliable, secure and bank grade. You can utilize it for all kinds of online bill payments or online recharge that any mobile wallet can be used for. In addition, it can be used to pay while shopping on online portals (as it has partnered with more than 2000+ online merchants).

Visit below links for Oxigen Wallet

- Official Website of Oxigen

- Oxigen Wallet App Download for Windows

- Install Oxigen Android App

- iOS App of Oxigen Wallet

I just hope that the information in the blog is informative to the readers and will help them in the cash crunch situation prevailing in the country after the demonetisation. If you have any suggestions regarding the blog, put that in the comment section. Please, do post your views and queries regarding the post.

Best Mobile Wallet App for Android In India

https://www.blog.sagmart.com/wp-content/uploads/2016/12/Top-Mobile-Wallets-for-digital-India-300x300.jpg Mobile AppsTechnology Android AppsNovember 8, the day Prime Minister Narendra Modi announced the government’s decision to demonetize Rs. 500 and Rs. 1,000 notes, the scramble for alternative modes of money transfer has led many to the concept of mobile wallets. A Mobile Wallet is a form of an e-wallet which basically is a virtual wallet that allows people to store their money and use it for people-to-people transactions and making purchases. It does away with the need to input personal information and serves as a platform for both offline and online purchases. PM Narendra Modi in his speeches has called for a move from “less cash society to a cashless one”. It means the PM wants you to go digital with your wallet, or in simpler words to use e-wallets for day-to-day purchases and other transactions.

India aims to become cashless now. The online mode of payments has been increased, and most of us are looking for secure and safe ways of doing it. If you are also looking for the same, then this Blog is for you. In this blog, we are going to discuss the Best Mobile Wallets app that are currently available in India. The list below is mainly about the best mobile wallet app for Android as there are dozens of Mobile wallet solutions on offer today, from tech companies, telecom players, and banks. so, it’s important to know about the specific mobile wallets that can prove handy to you. The list below will help you decide as per your need by educating you about these major available e-wallets in the country.

Paytm:

Paytm is the most visible player in the e-wallet category in India. The company, which was founded back in 2010 as a mobile recharge website by One97 Communications, is now invested in by the likes of Alibaba and Ratan Tata. Paytm recently said that it recorded transaction worth Rs 120 crore on single day post demonetisation. While the app, which is available on every mobile platform, already had a vast outreach, after the demonetisation announcement by the PM it has become more visible.

Paytm can be accessed through its website and is also available on all the phone platforms as an app. By using Paytm you can pay phone and internet bills, utility bills like electricity, gas, and water. You can also pay DTH bills, recharge prepaid numbers and also recharge metro cards for Delhi and Mumbai metro trains. Paytm allows you to book tickets for the train, flight or bus journey. You can also book your stay at hotels through your Paytm account. Movie tickets can also be booked from the Paytm site and app. Using Paytm you can also pay school fees, buy gold in stocks or get a loan or insurance.

Paytm doubles up as a wallet, which means you can store money in it and use it when needed. Cab-hailing services like Uber, Meru, TaxiForSure and Jugnoo support Paytm Wallet, which means you can hire a cab and pay using the money in your Paytm Wallet. You can send and accept payments from customers, friends or family. It can be done by scanning a QR code or through OTP verification that works with a mobile phone. Paytm is accepted across a wide number of local kirana stores, retail store, restaurants, and petrol pumps. The app offers a “nearby” option which shows all the places near your location that accept payment through Paytm. Paytm is also accepted for most online retailers. Paytm also has its own online shopping market, where it sells products in women and men fashion, mobiles & electronics, home & kitchen, accessories, jewelry, home appliances, baby & kids and more.

Paytm is the most widely used way of offline digital transaction, which means it’s easy to find local stores where Paytm payment is accepted. As mentioned above, Paytm offers the widest range of options where it can be used. The money stored in Paytm Wallet can be used for sending money, purchases, cab rides and much more.

links for first-hand experience of Paytm services:

- Paytm official website

- Paytm App Free Download on Android

- Install Paytm App for iOS

- Windows Paytm Application Download

- Paytm App Installation for Blackberry

Mobikwik:

Mobikwik is another option available to Indians when it comes to the cashless transaction. It also started as prepaid recharge website, it works closely similar to Paytm. However, the places and the services where you can use Mobikwik are fewer. Mobikwik is available on Android, iOS and Windows platforms.

Mobikwik is another option available to Indians when it comes to the cashless transaction. It also started as prepaid recharge website, it works closely similar to Paytm. However, the places and the services where you can use Mobikwik are fewer. Mobikwik is available on Android, iOS and Windows platforms.

Most of the services offered by Mobikwik are the same as Paytm. It allows mobile recharge, bill payments for utilities like electricity, water, and gas. You can also pay DTH, internet bills. Mobikwik allows bus and train bookings but not flights. Mobikwik payment is accepted at more than 5000 restaurants, cafe, supermarkets, gift shops & physical stores.

The Mobikwik wallet option is also supported for online transaction on several websites. Transfer and receive money through the app. Accepted at a lot of places. Allows transferring money back to the bank account. Mobikwik Lite offers smooth functioning even on the slow internet. It doesn’t require a smartphone. Limited reach compared to Paytm.

For further information, one can access below links

- Mobikwik Website

- Free Download MobiKwik App for Android

- Download MobiKwik iOS App

- Install MobiKwik Windows App

Recommend read: Top 5 Video calling apps for distance calling

Freecharge:

Freecharge works and offers services more or less similar to Paytm and Mobikwik. The app is available on Android, iOS, and Windows mobile platforms. While the Freecharge payment is not accepted on major services like Uber and Ola, it offers some interesting features like “split bill”, which allows you to split the amount to be paid among your friends.

Freecharge works and offers services more or less similar to Paytm and Mobikwik. The app is available on Android, iOS, and Windows mobile platforms. While the Freecharge payment is not accepted on major services like Uber and Ola, it offers some interesting features like “split bill”, which allows you to split the amount to be paid among your friends.

With the efficient Freecharge Wallet, it’s time to go cashless and reduce the extensive process of online and offline payments to just one tap. Freecharge has some of the most popular merchants on board – for categories like food, entertainment, travel & shopping.

Use below links to access Freecharge

PayUmoney:

PayUMoney, a Gurgaon-based company that provides online payment solutions launched its wallet service last year. This e-wallet by PayUMoney enables the user to store cash and pay for various services and transactions.

PayUMoney, a Gurgaon-based company that provides online payment solutions launched its wallet service last year. This e-wallet by PayUMoney enables the user to store cash and pay for various services and transactions.

In order to differentiate themselves from other players, they provide a wide range of benefits that include one-touch checkout and discounts/cashback offers on every transaction made. This e-wallet also provides instant refunds on order cancellations to ensure the right purchase and customer satisfaction.

You can access PayUmoney service by:

Recommend read: Best Smartphones Under Rs. 10,000

Oxigen Wallet:

The Oxigen wallet (e-wallet) is powered by Oxigen Services India Private Ltd., that was founded way back in 2004 by Pramod Saxena in the tie-up with Blue Label Telecom, which is a South African company. Though it ventured into the online mobile wallet space only in 2014, it has established itself as a leader among retail outlets for payment services with more than 1,30,000 outlets across India and more than 35 million transactions being conducted on a monthly basis.

The Oxigen wallet (e-wallet) is powered by Oxigen Services India Private Ltd., that was founded way back in 2004 by Pramod Saxena in the tie-up with Blue Label Telecom, which is a South African company. Though it ventured into the online mobile wallet space only in 2014, it has established itself as a leader among retail outlets for payment services with more than 1,30,000 outlets across India and more than 35 million transactions being conducted on a monthly basis.

Oxigen Wallet is a prepaid non-bank wallet that has been approved by RBI. It has emerged as India’s first non-bank wallet in the tie-up with NPCI for instant money transfer services. You can use Oxigen wallet to transfer money quickly from your mobile at any time and from anywhere. The transfer can be made to any mobile phone number on any cellular network in India as well as to any bank account PAN India using IMPS (Immediate Payment Service) or NEFT transfer to most major banks like SBI, Citibank, Axis bank, HDFC Bank, Yes bank, ICICI Bank, IOB, PNB, etc. in India.

The best part about Oxigen wallet is because it is certified by RBI, it is pretty reliable, secure and bank grade. You can utilize it for all kinds of online bill payments or online recharge that any mobile wallet can be used for. In addition, it can be used to pay while shopping on online portals (as it has partnered with more than 2000+ online merchants).

Visit below links for Oxigen Wallet

- Official Website of Oxigen

- Oxigen Wallet App Download for Windows

- Install Oxigen Android App

- iOS App of Oxigen Wallet

I just hope that the information in the blog is informative to the readers and will help them in the cash crunch situation prevailing in the country after the demonetisation. If you have any suggestions regarding the blog, put that in the comment section. Please, do post your views and queries regarding the post.

Leave a Reply